Role: End to End Product Design Lead

Responsible for:

UX research

Interaction design

Prototyping and testing

Visual and motion design

Final handoff and QA

Contributing team: Product manager, engineering lead, 6 engineers

Overview

I designed, validated, and shipped a next-generation membership experience for LendingClub’s 5 million active customers that culminated in a 30% YOY lift in loans issued to existing members, and led to the company’s first $1B quarter for loans of this type. While I'm proud of the measurable impact this project had on business metrics, I'm especially proud of the impact this work had in informing and enabling a customer-focused strategy for LendingClub for 2019 and beyond.

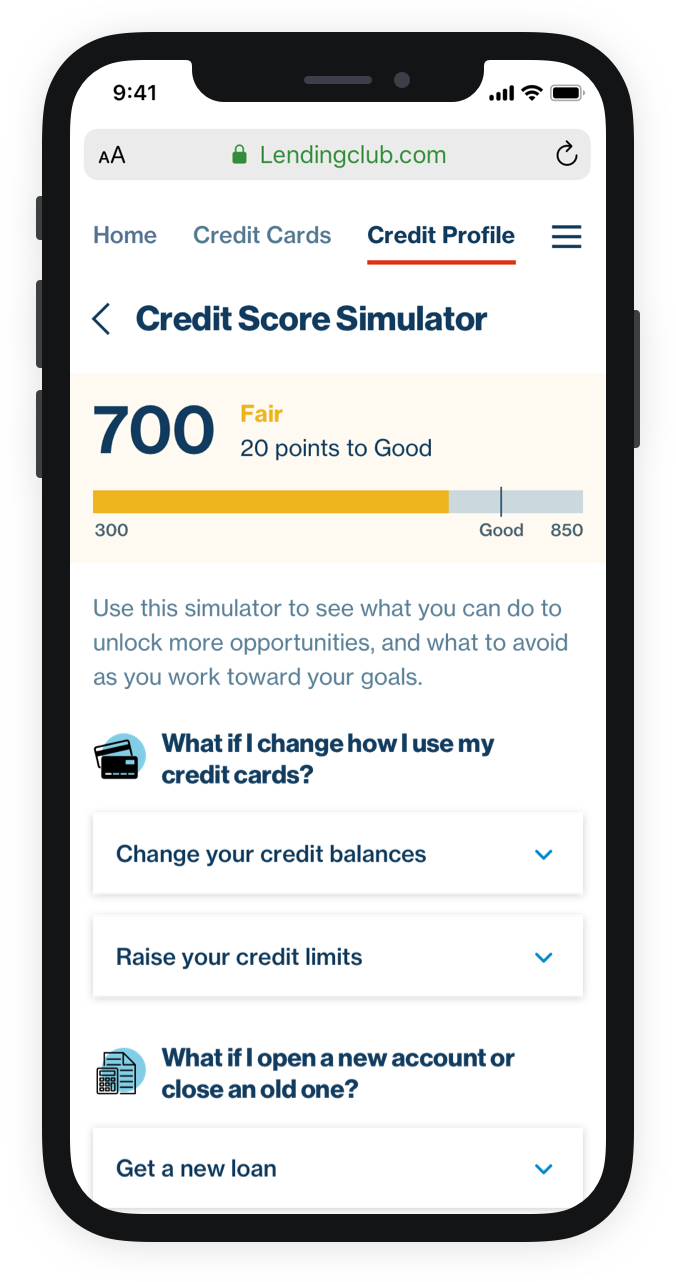

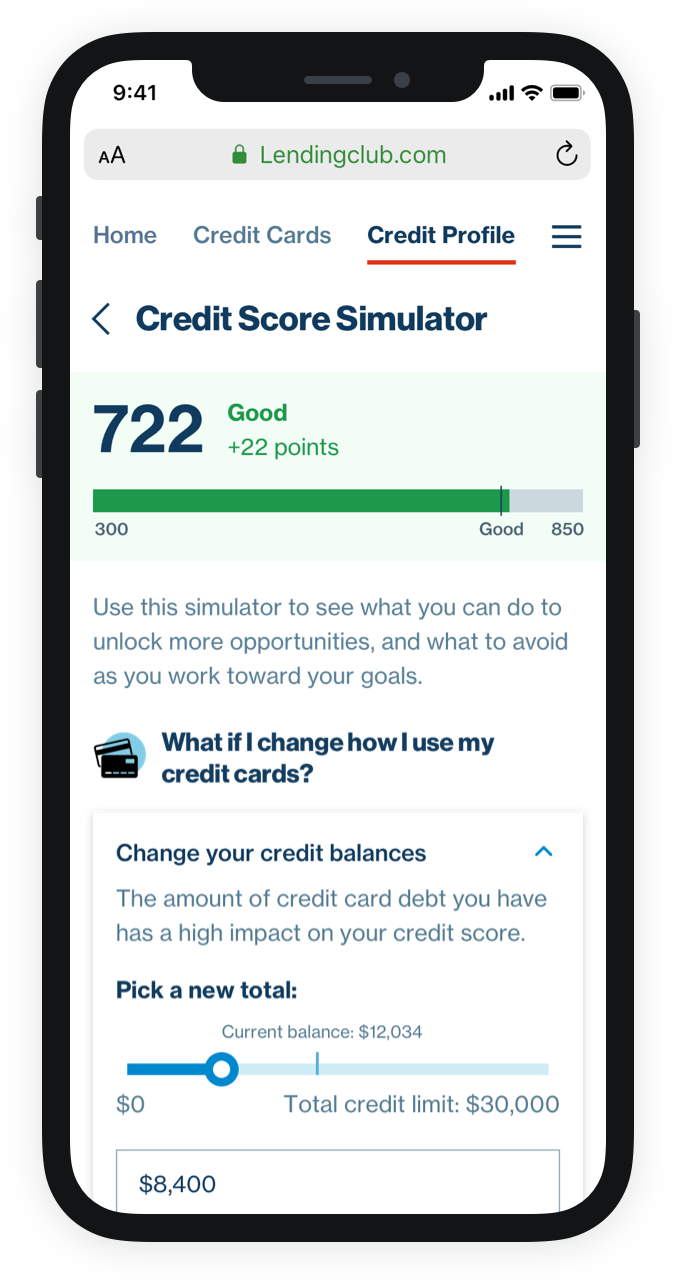

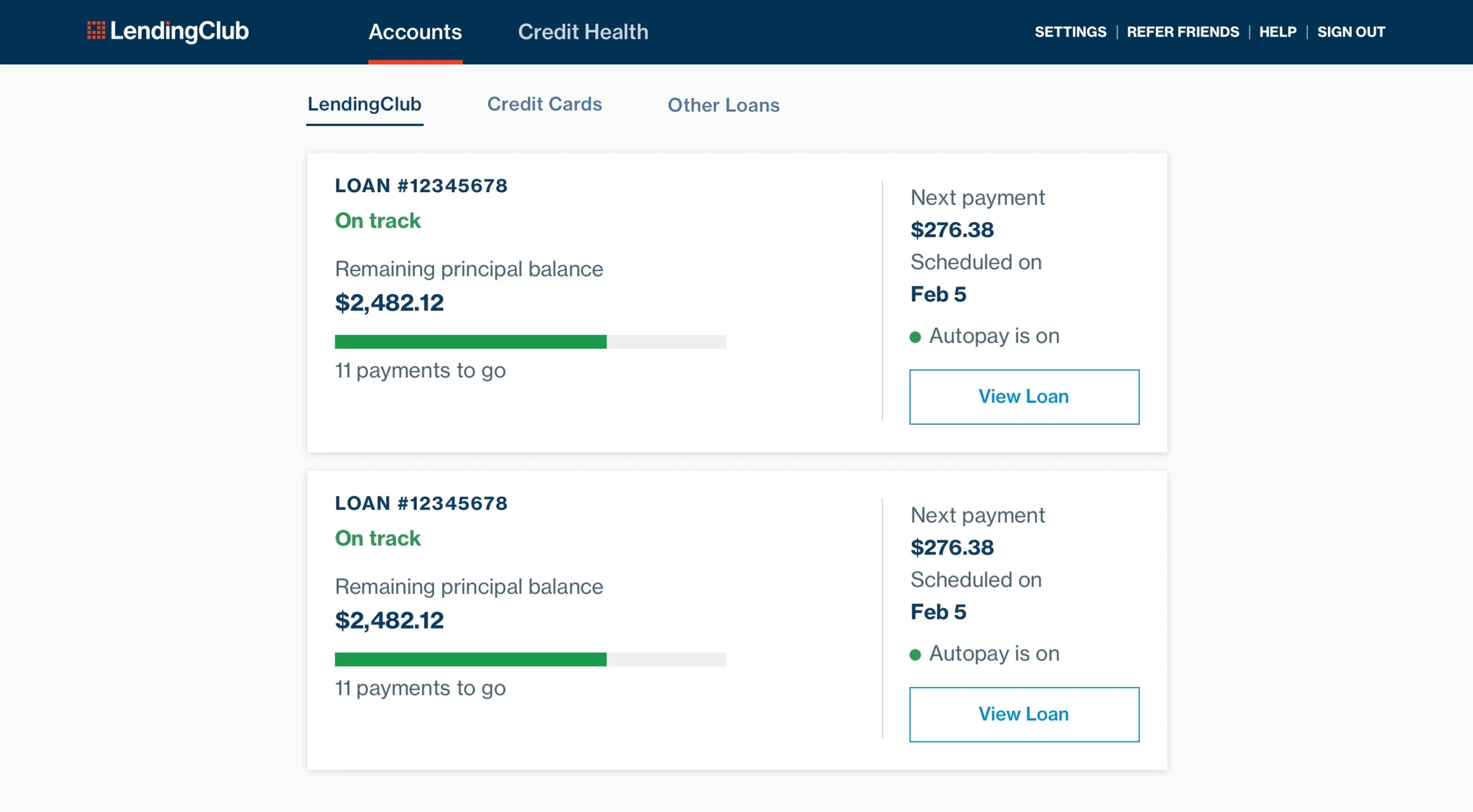

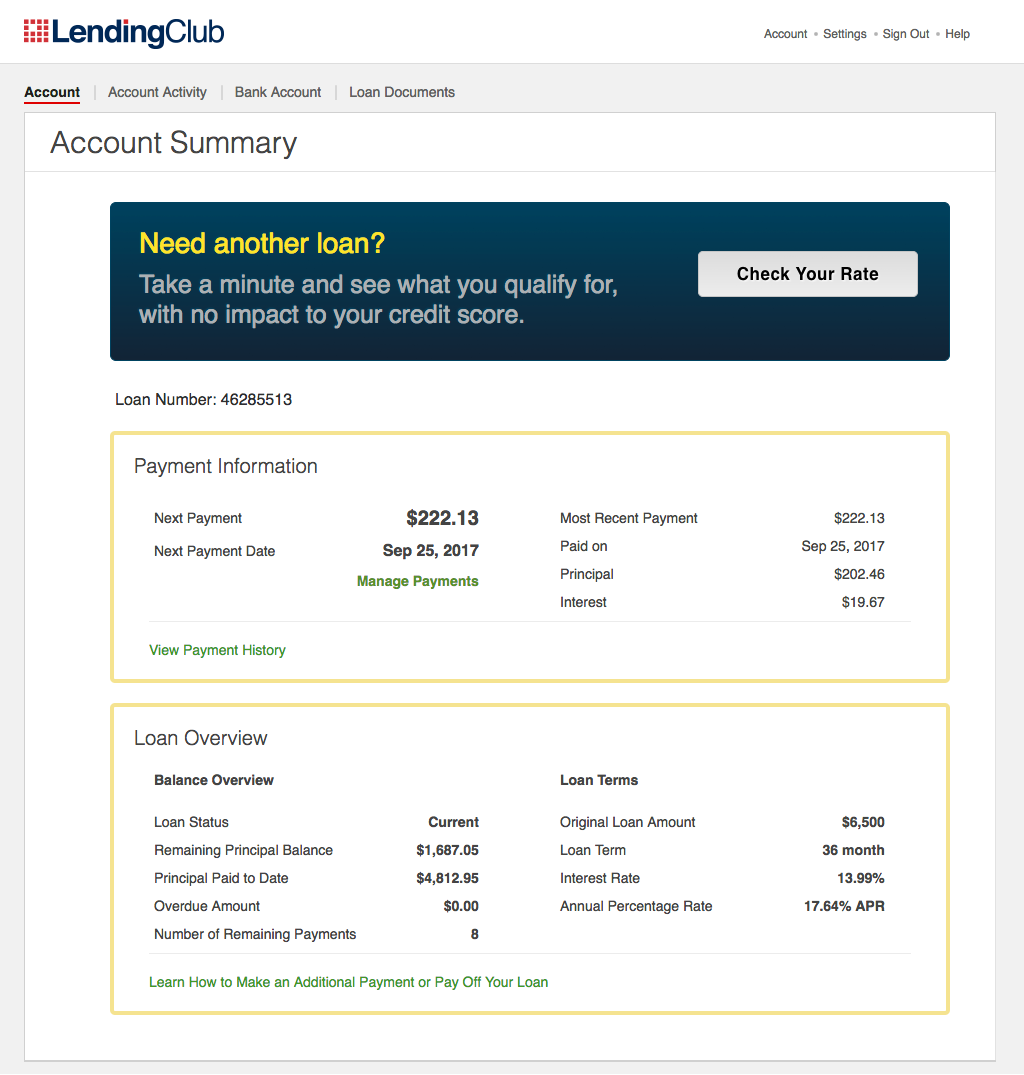

Members get an at-a-glance snapshot of their loans when logging in to the desktop web experience. (Example shown)

A Key Problem: Historical focus on acquisition and growth created a transactional and impersonal membership experience for members

LendingClub is a peer to peer lending marketplace that connects borrowers with investors. They are the market leader in personal loans, having issued more than $15 billion in loans since 2018.

To get to where the company is today, acquisition and growth were historically the primary focus of the product team's efforts. The result of this was a transactional and impersonal post-issuance experience (the experience after the loan has been received by the customer) with limited value to users. This created a huge experience and business opportunity to build lasting relationships with customers and treat them less like visitors and more like real members.

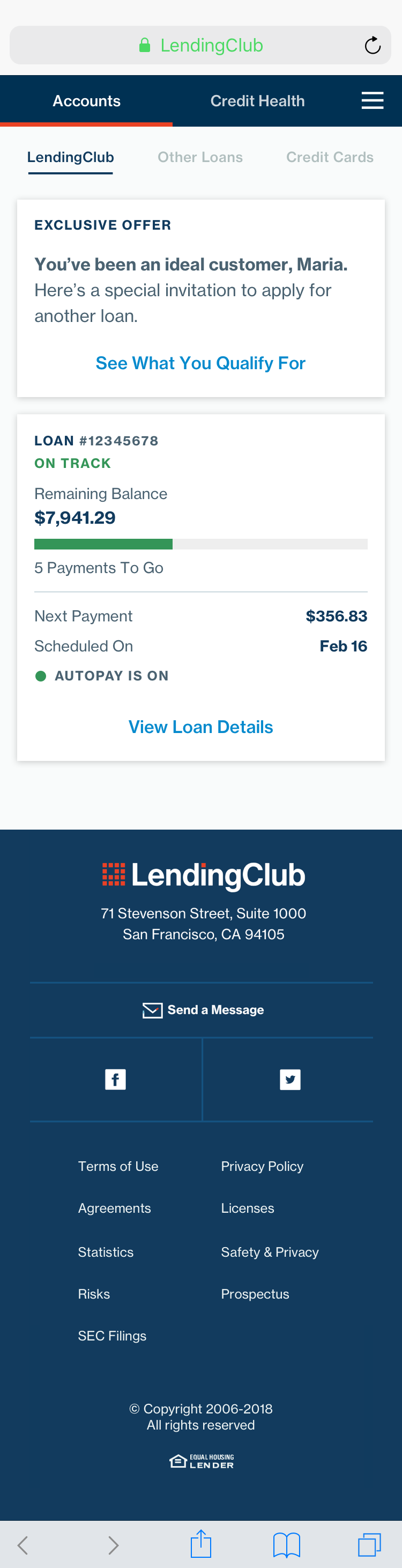

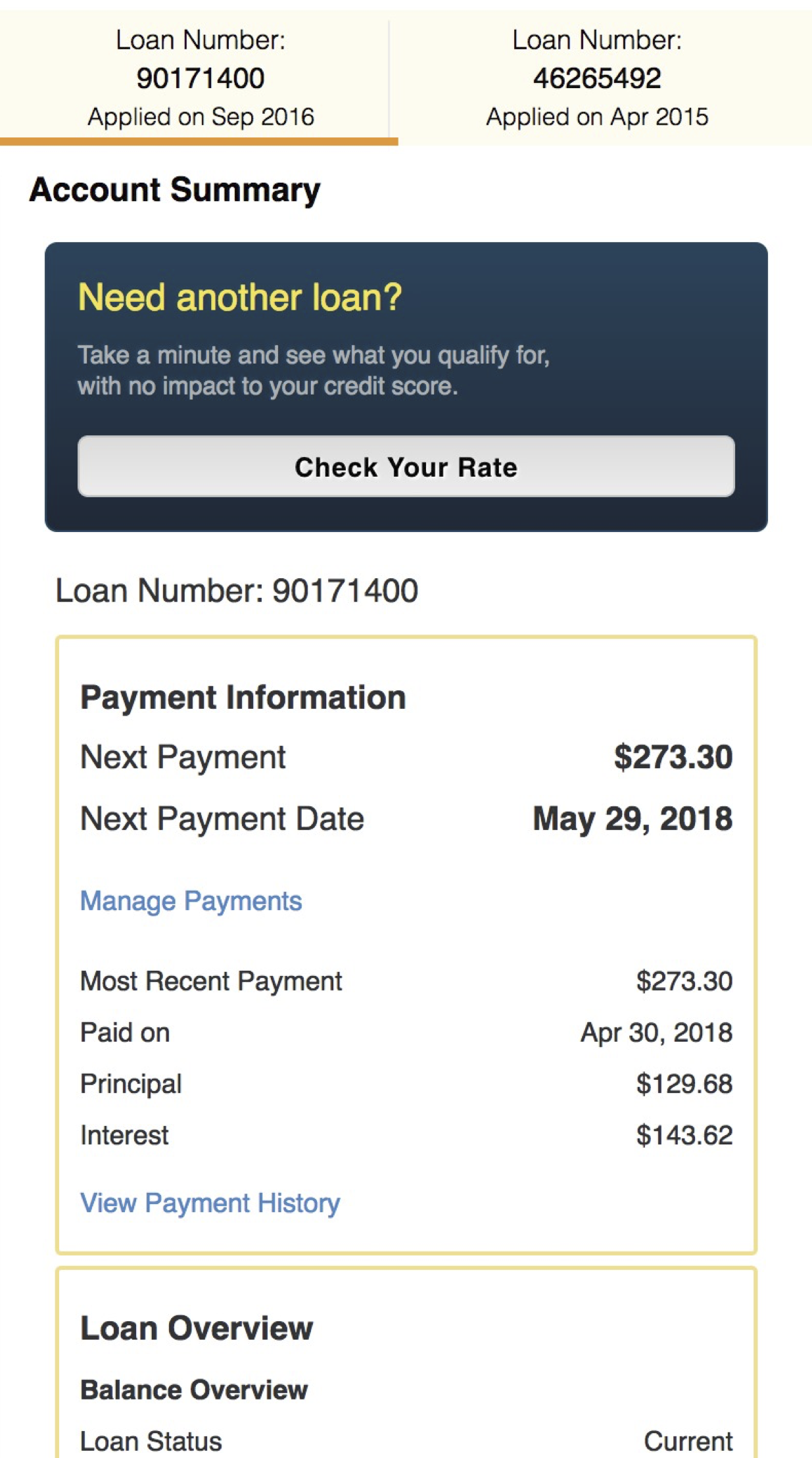

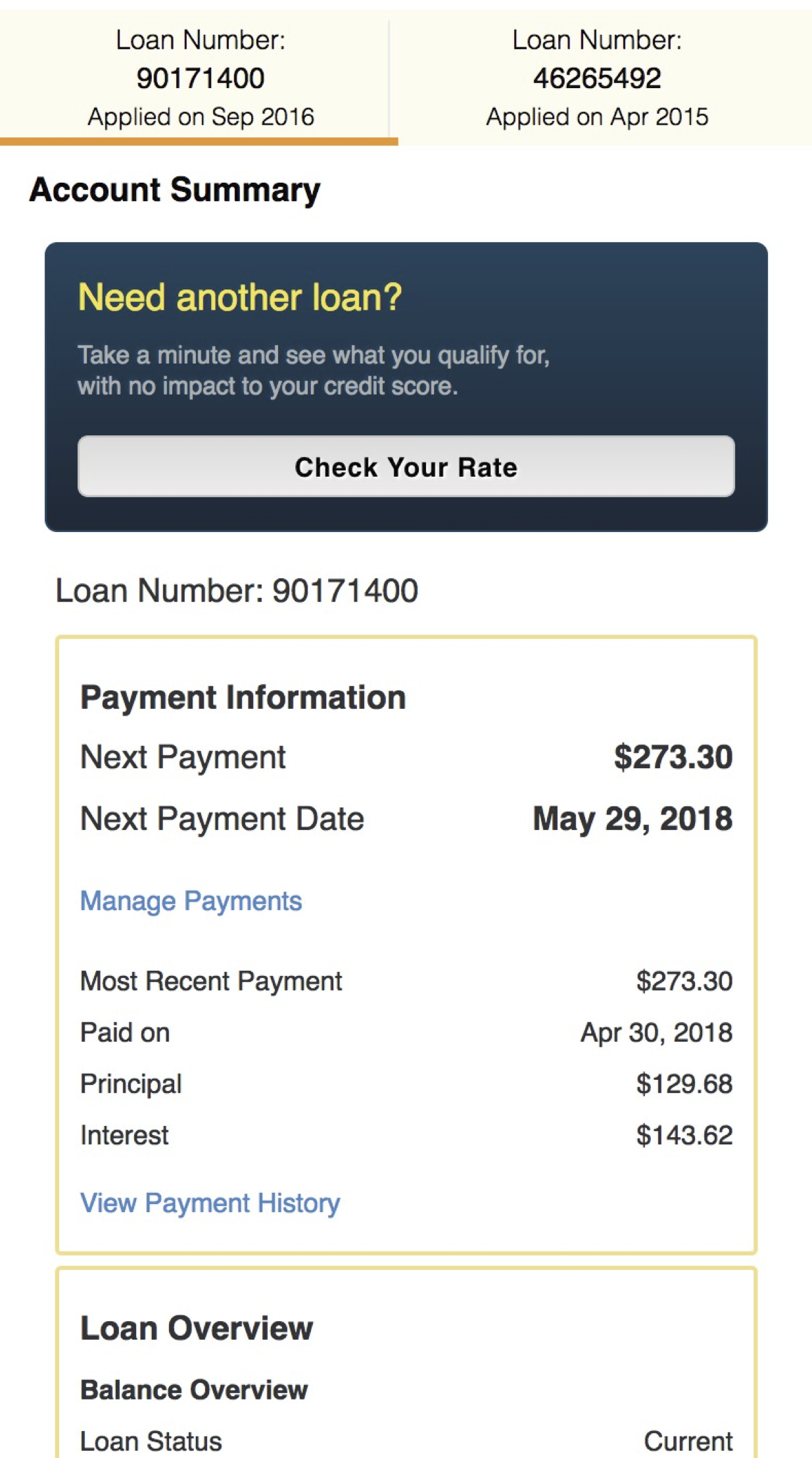

LendingClub’s post-issuance experience in 2017

Definition and Discovery

Because this was a true redesign project, it was necessary to establish a baseline understanding of the experience at the time. I led user testing sessions to identify opportunities and gaps in the experience. This qualitative data, combined with learnings from competitive analysis allowed me to hold thoughtful cross-functional brainstorms and workshops with clear goals.

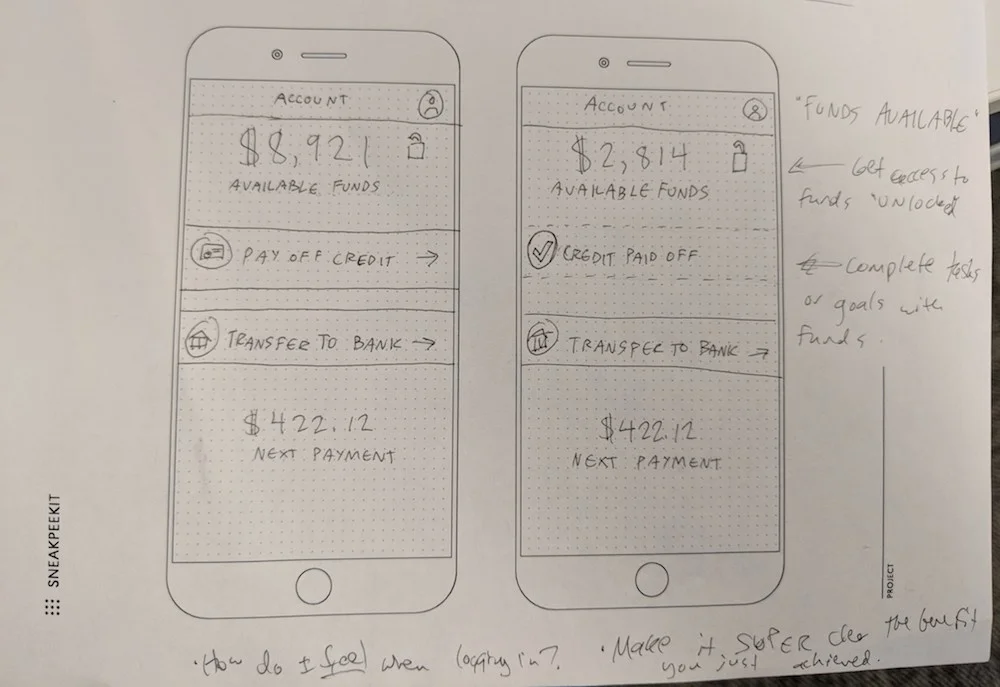

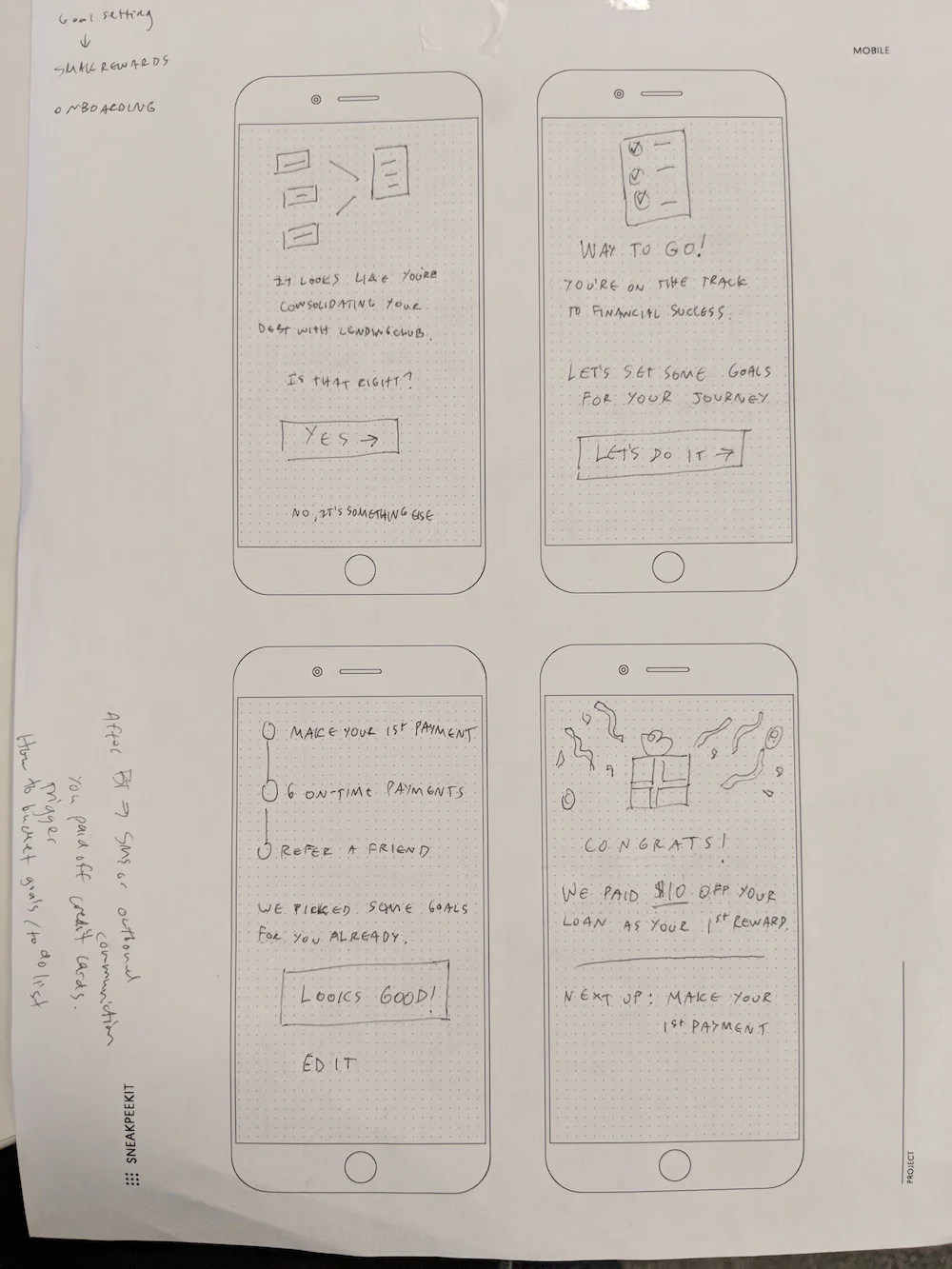

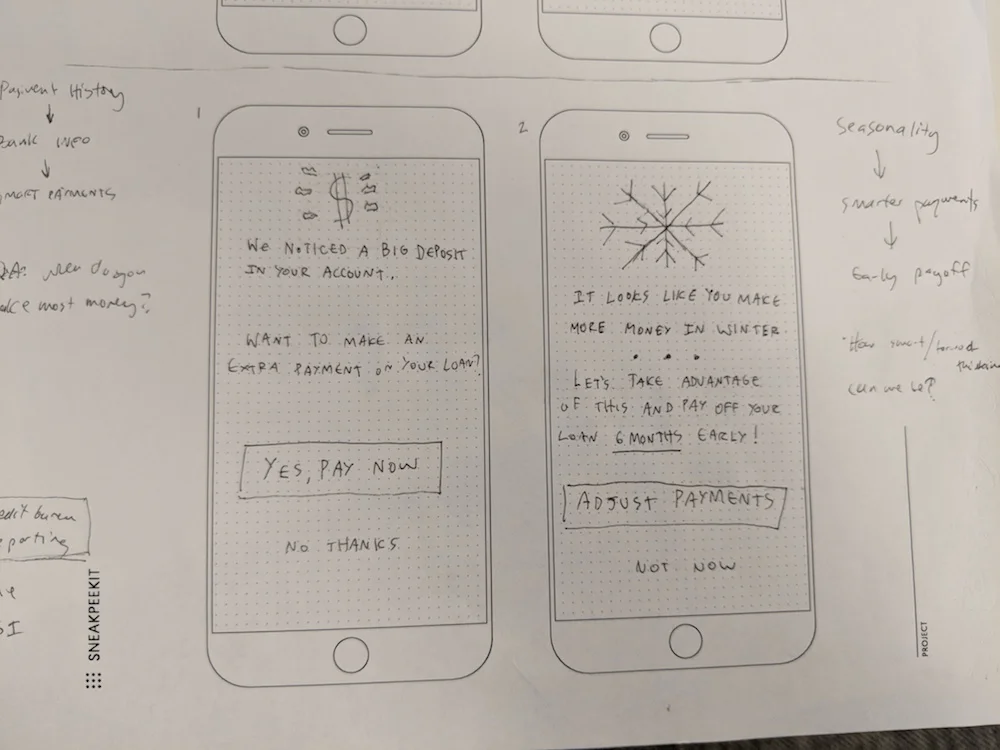

What does it mean to be a member of LendingClub? A selection of sketches and notes from a cross-functional workshop I led with engineering, product, and marketing stakeholders.

After synthesizing learnings from testing and these cross-functional workshops, I worked with my product manager and engineering lead to solidify UX and business goals to inform work going forward:

Business goals:

Increase the volume of loans taken by existing members through the platform

Maintain critical loan servicing and collections metrics

Build a scalable platform to support new products and experimentation

UX goals:

Simplify loan servicing and payment flows for members

Make it easy for members to access loan applications in progress, completed loans, and important documents

Reduce confusion regarding late payments and fees

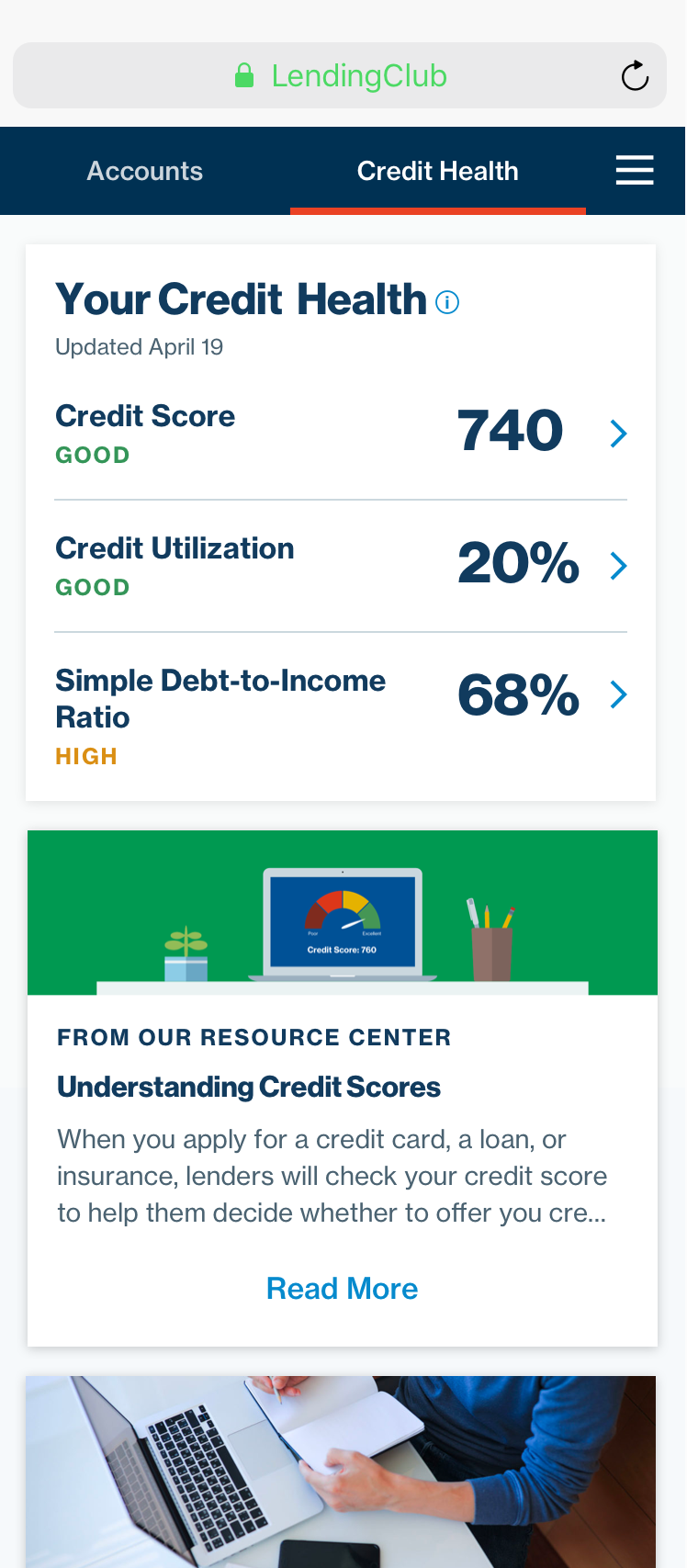

Empower members to continue on the right path after taking their first loan

Creating a practical north star vision, and thoughtfully building toward its value proposition

Aside from creating cross-functional alignment and buy-in early on, these workshops provided the inspiration and fuel for ideation. Sketching design ideas allowed me to quickly communicate ideas to stakeholders and get directional feedback.

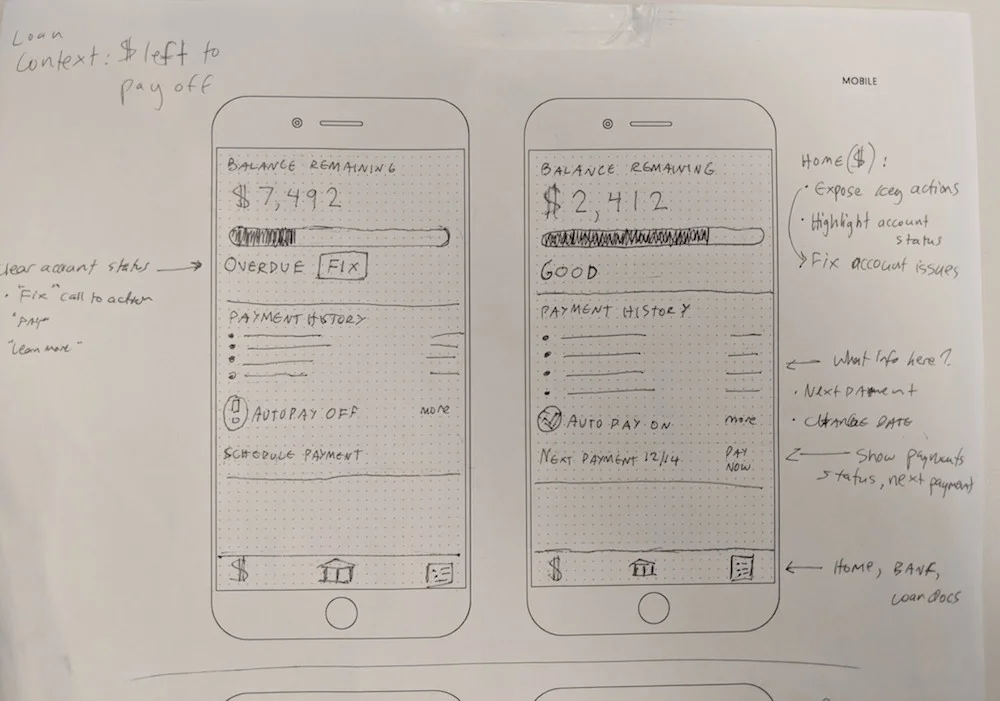

Selection of sketches and wireframe concepts from the ideation phase.

Many of the concepts I proposed and prototyped reflected significant hurdles in technical capabilities from where the product at the time. Since getting stakeholders excited is meaningless if the design isn’t feasible to build, I took at practical north star approach with design. By starting with the “in a perfect world” design and value prop, we could thoughtfully and incrementally build toward a compelling vision. In this case, our value prop was a broad yet simple echo of our UX goals: empower members to continue on the right path financially after they take their first loan.

Validating a leap of faith with a key test

When it came to building out and implementing the design direction, we needed to validate assumptions we were making about the structure of the experience and its impact on some key metrics. If we were to continue in this direction, we needed to show that the new design didn’t negatively impact performance of loans issued through the platform. To test our hypothesis that improving navigation, visual hierarchy of information, and including a few oft-requested bits of information about customers’ payments and status would provide a lift to loan applications, we A/B tested a stripped-down version of the design that our engineers could tackle in a sprint’s worth of work against the control experience. In reality we saw a 15% lift in our success metric. This success gave us validation to continue working toward the north star vision.

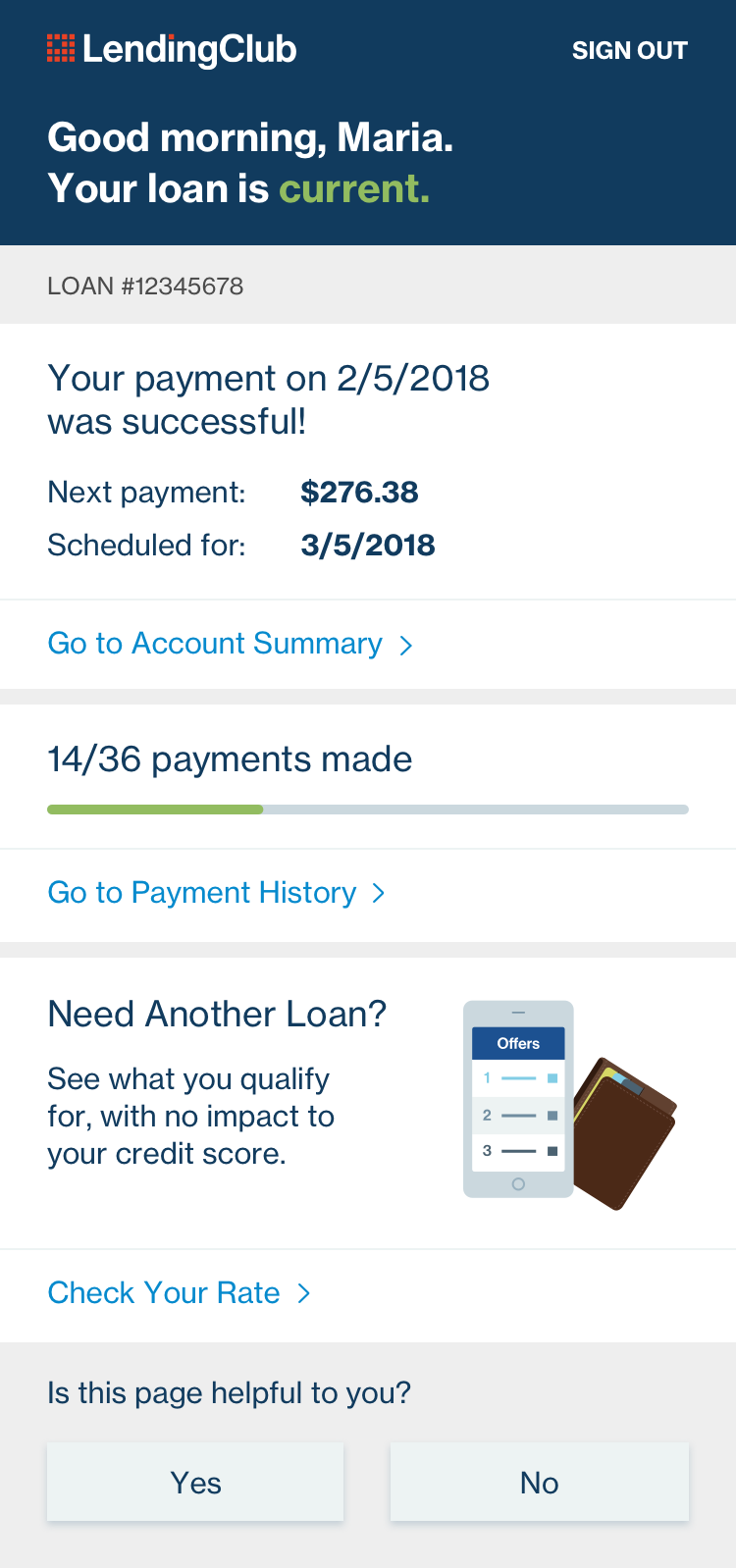

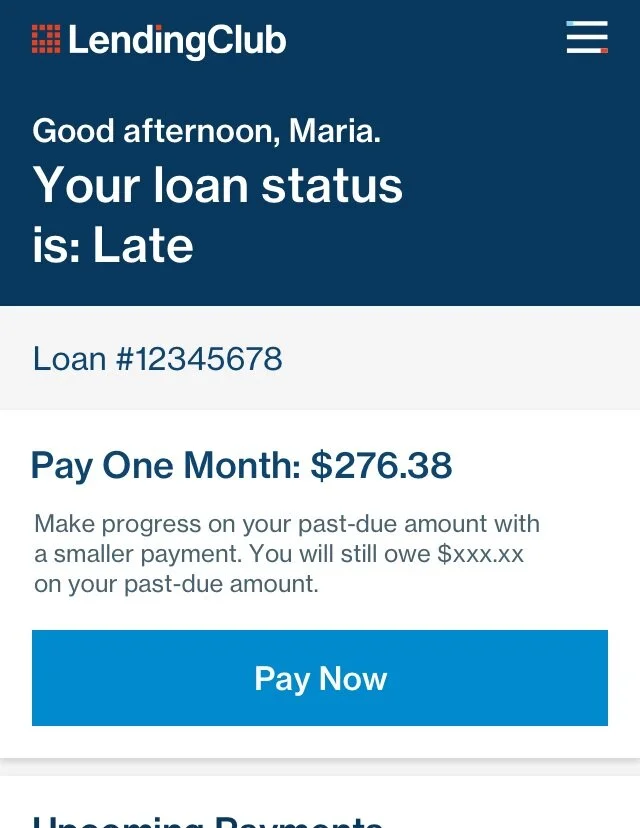

Experiment used to validate design direction. Resulted in 15% lift in new loan applications, our success metric.

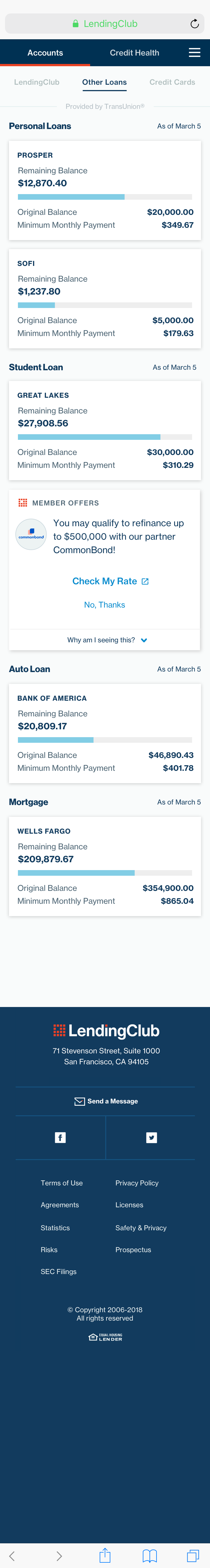

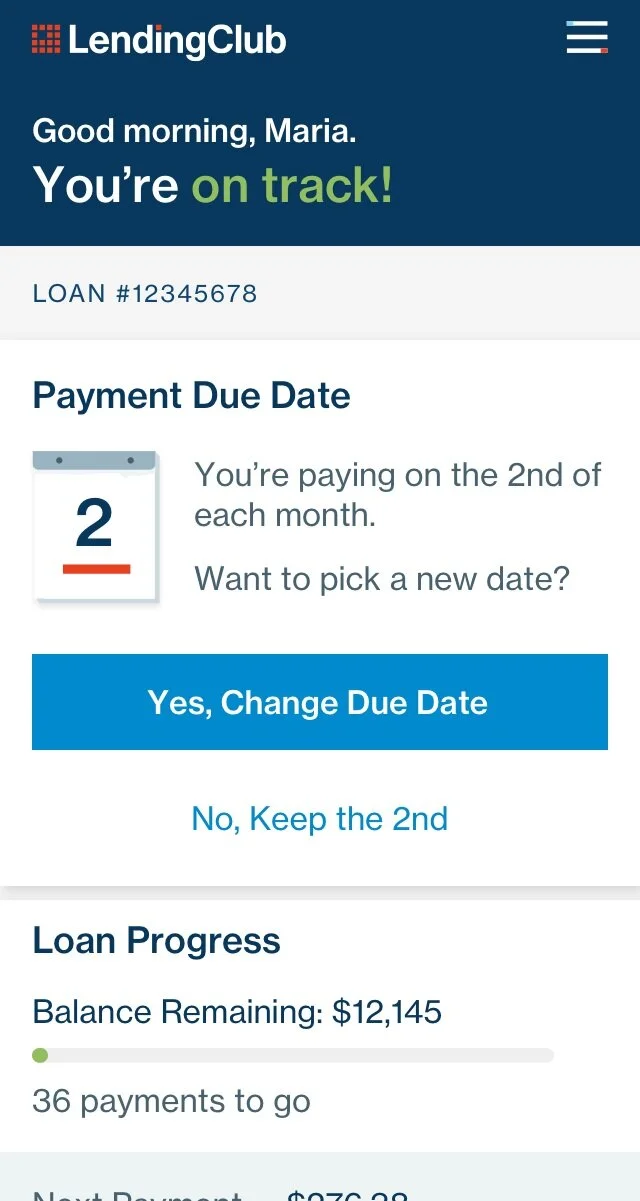

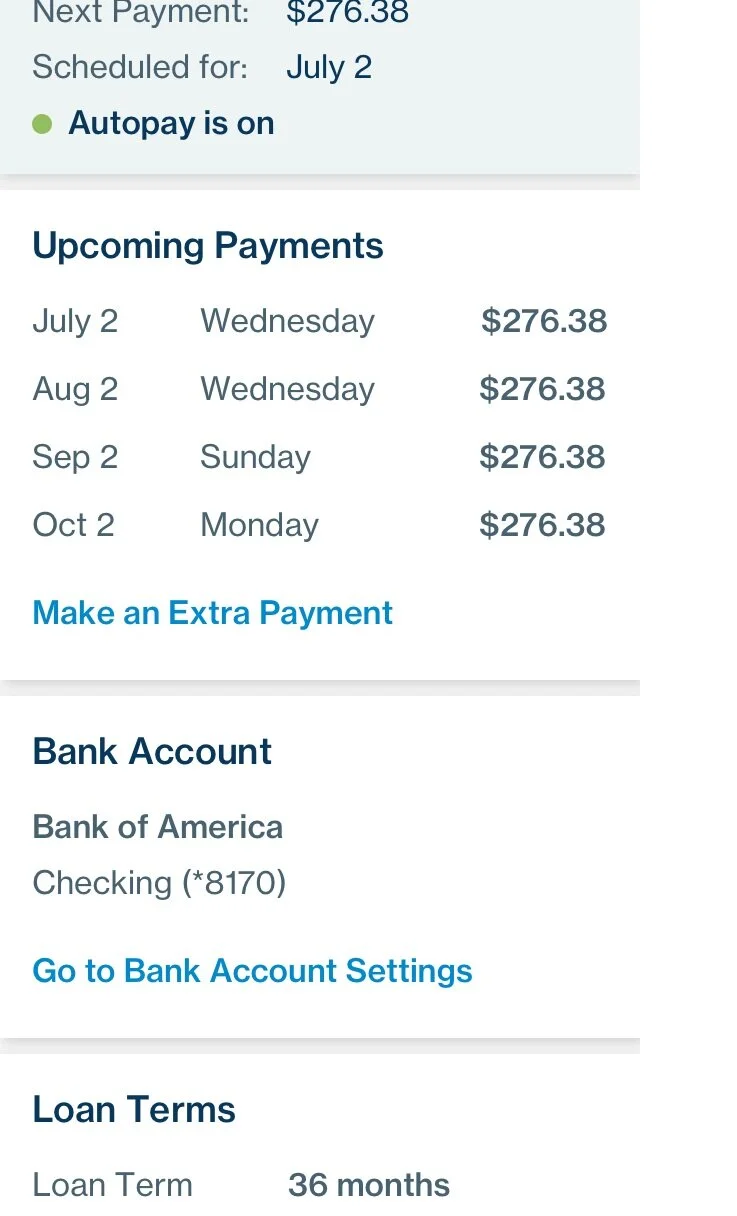

By collaborating closely with engineering we shipped incremental updates sprint by sprint to what was now gaining recognition internally as our new “Member Center,” a far cry from the transactional post-issuance experience I had inherited. By cutting the updates into customer segments, we eventually routed all LendingClub customers to the new Member Center, building in improvements along the way to make it easier to make payments, customize their experience, and other quality of life improvements.

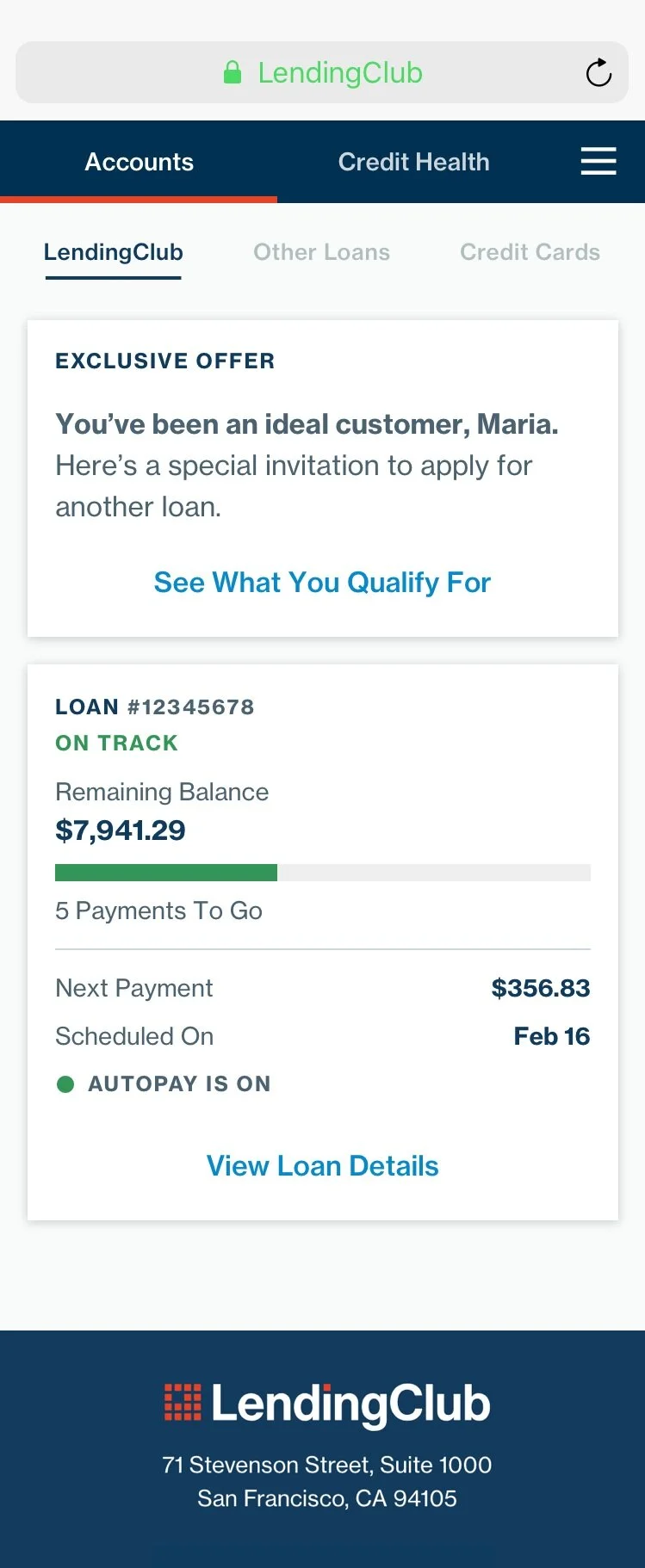

Examples of “smart cards” surfaced to customers depending on their loan status, due date, and other factors.

Using a modular, scalable foundation to build on results

UML diagram showing modular nature of the membership platform.

The A/B experiment outlined above is just one example of why I’m proud of this project: By designing the post-issuance experience as a modular, scalable platform as opposed to a static account experience, we enabled the plug-and-play testing required to learn fast and innovate.

Results: LC’s first $1B quarter for repeat loans, 30% growth YOY

Thanks to the streamlined user experience, experimentation, and flexibility allowed by the new platform, loans issued to existing customers crossed $1 billion in one quarter for the first time in LendingClub’s history. This represented a 30% growth YOY.

Old Experience

Old design as of Q4 2017

New Experience

Updated design as of Q3 2019

New Experience

Updated design as of Q3 2019

Next Steps

We released LendingClub’s first set up financial health tools and trackers onto the platform, and are working to validate new features and additions to the experience.

We’re also working closely with other product teams to integrate and enable new cross-product experiences to allow other business units to take advantage of the new platform’s capabilities.